It doesn’t matter how good it is as a merchant and how big it is its commercial strategy, soOoner or later, will experience the loss of exchanges. What separates the professional from the amateur merchant is how well the losses can handle.

In this context, one of the most important obstacles for merchants, learning to discern between inevitable and expensive prevention errors is. This distinction is very important to build a resistant commercial mentality and a long -term success.

I recorded a podcast On this same topic that you can find here:

Listen in the browser: https://www.podbean.com/ew/pb-ppu-172f57c

Spotify: https://open.spotify.com/episode/60gdmfcgdm2uyffmkhdpe?

1. The nature of commercial losses: Good vs. bathroom

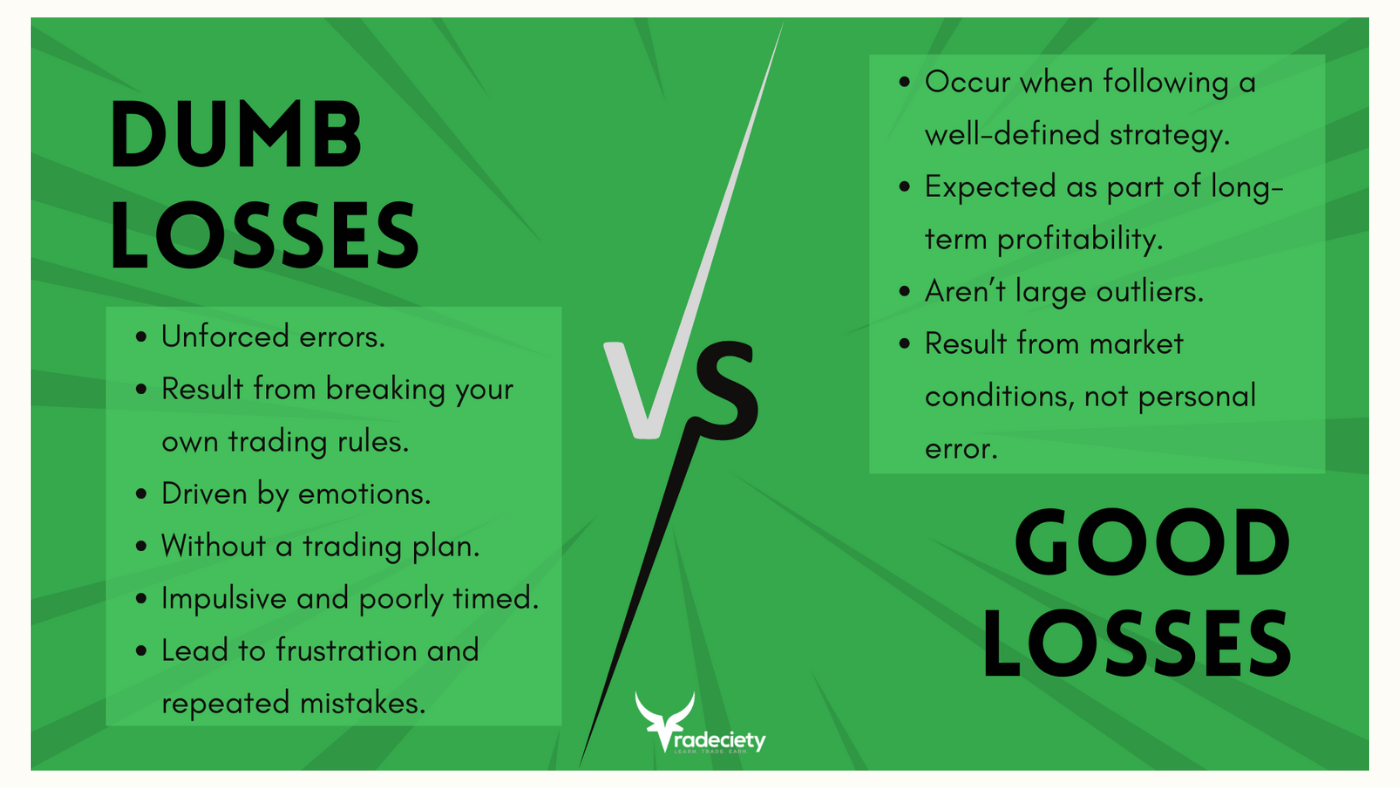

Each merchant will face losses, it is simply part of the game. However, not all losses are the same. Distinguishing between “good losses” and “silly losses” can transform the way it perceives and learns from setbacks.

Good losses: a part of the plan

Good losses occur when adheres to your commercial strategy and follows its rules, but market conditions do not favor it. These losses are expected, only in a solid commercial system. Approximately “good losses” do not prevent profitability, but they are part of a bigger and more successful approach.

Advice: If it is new in commerce, one of the best ways to feel comfortable with the inevitability of good losses is to support your strategy. Spend some weekends collecting data from several markets. This practice will reveal that it can lose 50% of its operations and remain profitable in the long term. This realization can be a revelation and provide confidence in attating the difficult times of your strategy.

Silly losses: the cost of error

Tontal losses are prevented and occur when deviating from their negotiation plan. These may result from emotional trade, enter without a clear plan or ignore your established risk management rules. Recognize and Mini -Mini -te can help protect its capital and keep it on the way to constant growth.

2. Process -oriented mentality

Instead of evaluating success exclusively for profits and losses, a process oriented by the process measures performance by fulfilling its negotiation plan. Did your entry and exit strategy follow? Were your appropriate commercial sizes and time? This perspective helps you maintain consistency, refine your approach and avoid exhaustion.

Reflect and review: After each trade, species to the losers, reflect on these questions:

-

Did I follow my commercial rules?

-

Was the previously planned or impulsive trade?

-

Were there hidden influences at stress, such as stress or market exaggeration?

This reflexive practice helps you detect behavior patterns, such as the fear of getting lost (fomo) or trade revenge, keeping you responsible and disciplined.

3. Weekly improvement

An effective method for growth is to identify a key area to improve every week. For example, if you notice a rape habit when bored, write it and place a reminder next to your commercial screen. Make it your mission for next week not to repeat that behavior. Approximately time, small specific adjustments can lead to significant progress.

4. Avoid arbitrary return goals

Establishing rigid financial objectives such as “I need to make 10% this month” can exert undue pressure on you to force operations that are not aligned with market conditions. Unlike a work of 9-5, trade requires flexibility and adaptability. The market dictates opportunities, not its calendar.

Better practice: Concentrate in taking quality operations as they come, instead of trying to achieve arbitrary objectives. This reduces forced decisions and allows you to remain aligned with your strategy.

5. The value of moving away

A common error among merchants is the need to constantly be in a trade, even if there is a solid configuration. This leads to unnecessary and impulsive trades. Knowing when to step back and take a break can be as important as entering an exchange. The breaks help clarify their mind, restore their strategy and improve discipline.

Signature that is time for a break:

6. Recognize and mitigate excessive risk

Sometimes, merchants take higher risks due to exaggeration or the desire to quickly recover from losses. This behavior can be destructive and counterproductive for long -term success. If you realize that it assumes larger risks than usual, pause and reflect on the underlying motivation. Are you trying to “update” after a bad streak, or feel pressured by the market or social factors?

Adjustment strategy:

Takeeways processable for each merchant

To conclude, here there are six steps to integrate into your negotiation routine today:

-

Differentiate losses: Understand and accept “good losses”, but strives to minimize silly.

-

Adopt a processes oriented approach: Concentrate in executing your strategy well, not only in the result.

-

Reflect regularly: Analyze your operations in your negotiation diary to detect patterns and improvement areas.

-

Avoid rigid gains objectives: Take what the market sacrifices and does not work.

-

Control external influences: Only incorporate tips align with your strategy.

-

Mitigate excessive risk: Have a ready -size position plan that indicates how much to risk by trade.