The successful trade depends on recognizing the structures and patterns of the market that indicate whether an existing trend will continue. Trending patterns are important for merchants seeking to capitalize on the impulse of the market. This guide will cover the continuation patterns of more effective trends, shedding light on how merchants can use them to identify profit opportunities.

2. What are trends continuation patterns?

The continuation patterns of trends are formations of graphics that indicate a temporary pause in a prevailing trend, which suggests that the trend will probably resume after the pattern is completed. These patterns are important because they help merchants detect opportunities to join a trend after a phase of consolidation of cards, improve entry time and minimize the risk of buying or selling at the wrong time.

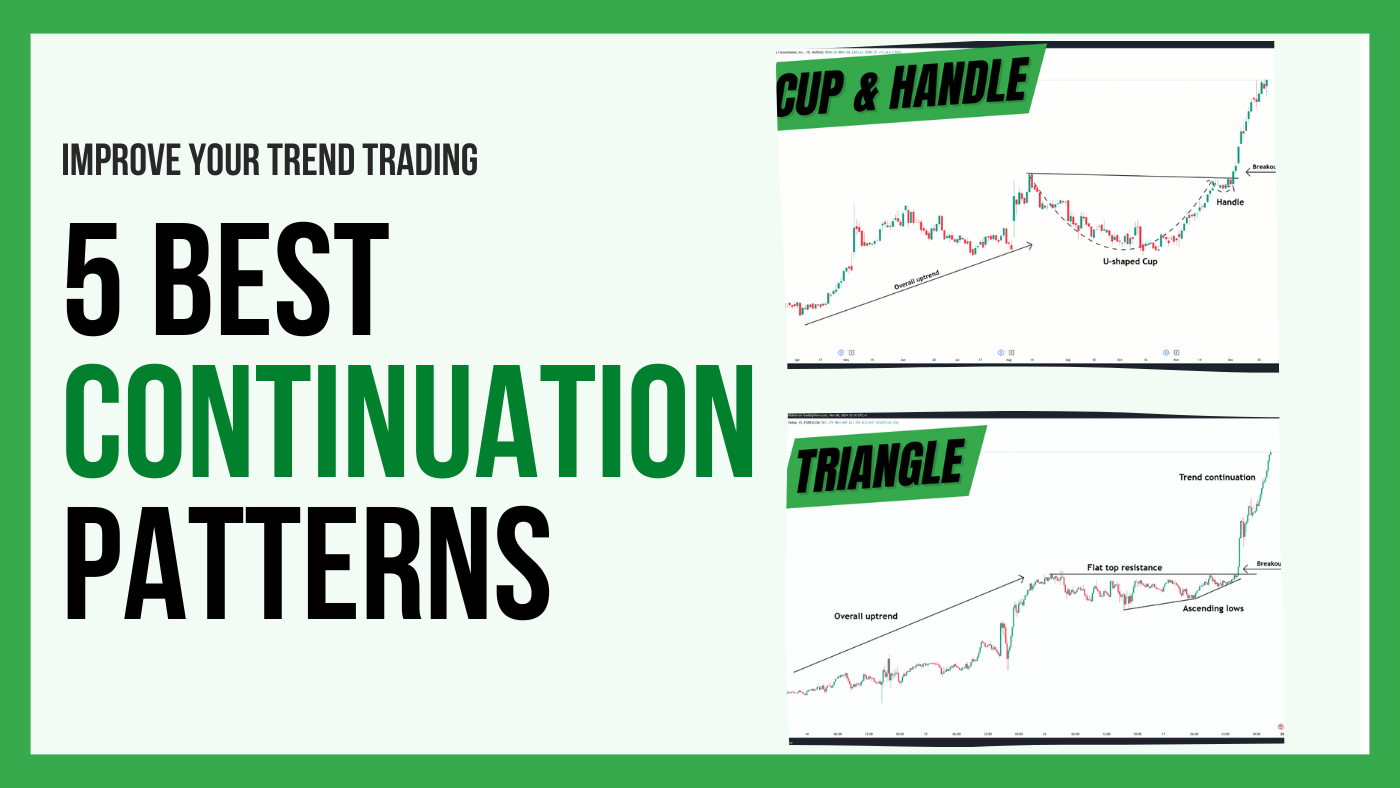

Next, we will cover the most important and popular continuation patterns. The key to finding the best proof of continuation is the context of general trend in which the patterns occur. When you see an ascending triangle, for example, you want it to form after a phase of anterior upward trend. Most merchants forget this important aspect and then encounter problems with their patterns by trading because they exchange patterns in the wrong context. Therefore, ensuring analyzing the general duration of the context of the trend, what form of patterns is the most important aspect of finding the best continuation patterns.

3. Continuation patterns of explained main trends

to. Flags and flags

Description: Banderas and flags are short -term continuation patterns that are formed after an abrupt price movement, known as the flag. The flags are marked by parallel support and resistance trend lines, while the flags have lines of trend that converge, resemble a small symmetrical triangle.

Visual characteristics:

-

Flags: A narrower and convergent form that resembles a wedge or a symmetrical triangle.

Entry and exit points:

-

Entrance: Operators generally enter an operation when the price leaves the flag or flag in the direction of the previous trend.

-

Exit: A common strategy is to establish the goal objective equal to the length of the ASA.

b. Ascending and descending triangles

Explanation: Ascending triangles form the duration of the duration and are characterized by a horizontal resistance line and a support line up. Descending triangles appear in low trends with a horizontal support line and a low resistance line.

Rupture confirmation:

do. Cup and handling pattern

Training: The cup and mango pattern is an upward continuation configuration where the price forms a “u” -shaped cup followed by a small handle down. This employer points out that the market has consolidated and is ready to resume its upward movement.

The pattern’s handle is the most important signal because it shows that the pressure it builds under the resistance when the price does not go back. Therefore, the bass of the handle must be much higher than the low of the cup.

Duration:

Input strategy:

-

Entrance: Place a purchase order on the resistance of the mango.

-

Stain: Positioned under the lowering of the handle to minimize the risk.

-

Take-beates: Or established at a level equal to the depth of the cup.

d. Rectangles (consolidation patterns)

General description: The rectangles are formed when the price is consolidated from the side between the parallel support and the levels of resistance, which means a roast in the trend.

Trade triggers:

The entrance is confirmed when the price is broken above or below the rectangle pattern in the direction of the trend.

Risk Management Councils:

Always wait for confirmation before entering an exchange. False outbreaks are common in rectangles patterns, so it uses volume as an additional confirmation tool.

my. Inverted head and shoulders

Description: This pattern, generally associated with reversions, can sometimes indicate a continuation that cheats on an upward trend. It is formed when the price makes you balance minimal, and the medium is the lowest (the head) and the other two (the shoulders) are higher but almost equal.

Continuation context:

In an upward trend, the law of head patterns and inverted scar acts as a consolidation before the trend resumes.

Patterns formation:

The neckline, formed by connecting the peaks of the two shoulders, serves as a rupture level. A successful outbreak on this line indicates the continuation.

Input strategy:

-

Enter when the price is broken above the neckline, confirming the pattern.

-

Stain: Place a stop cap just below the right shoulder for protection.

F. internal day:

Training: When, the duration of a bullish trend, a small internal daily candle, a possible breakdown of the next day, can be a strong continuation signal. The patron of the impulse impulse of impulse can often observe the duration of a trend market.

Candle size:

The more the price of the previous impulse candle closes, the better the general signal will be. If the price can boost the previous impulse candle in a strong way, it points out too much trend opposition.

Input strategy:

After the daily internal candle has completely closed, merchants go to a lower period to search for short -term entry patterns. The merchant can choose any of the continuation patterns discussed preventively and wait for them to appear within the lower period after the internal candle has been closed.

4. How to identify a valid continuation pattern

The support and resistance levels are essential to define the structure of the pattern, they generally form the limits of trends continuation patterns.

Identifying lines of tendency also helps confirm the limits of the pattern and possible rupture points when it comes to patterns that do not follow the horizontal limits.

In an upward trend, observing higher minimums that are approaching a resistance level may indicate that pressure is being built. This observation is crucial for patterns such as triangles and cup and handles.

5. Commercial strategies using trends continuation patterns

Time frames:

You can see patterns such as flags and triangles in various time frames, from 1 hour daily graphics.

Use a higher time frame (HTF) to establish the tendency address and a lower time frame (LTF) to find entry opportunities using continuation patterns.

Entry and output strategies:

-

In general, merchants expect a complete candle that closes above the boundary of the pattern before executing an operation. Pending orders trade strategies are more prone to false signals, but some merchants can choose to place input orders slightly above rupture levels.

-

Establish the loss arrest orders below the recent swing bass (in bullish trends) or ups and downs (in low trends) for effective risk management. How close is the loss of stop at the level of rupture, the more vulnerable is the loss of stop to short -term volatility.

-

Define profits from the principle of measured movement, such as the height of the pattern. Alternatively, the use of a fixed reward: the risk ratio based on the loss of loss of loss is another great approach to solve objectives.

6. Conclusion

Trending patterns are invaluable tools for merchants that aim to assemble existing trends with more confidence and precision. Patterns such as flags, flags, triangles, cups and handles, and the rectangles sacrifice clear signals when they identify and negotiate correctly in the correct context of superior Timframe.

The enormous benefit of patterns trade is at its high level of objectivity. The patterns must be obvious when they form in their graphics, eliminating a lot of uncertainty and subjectivity that other commercial approaches provide.

Incorporating these patterns in their commercial strategy and practicing them in a demonstration environment or through historical data test can improve their technical analysis skills. Take the time to observe, practice and reveal your findings for constant growth in your commercial trip.