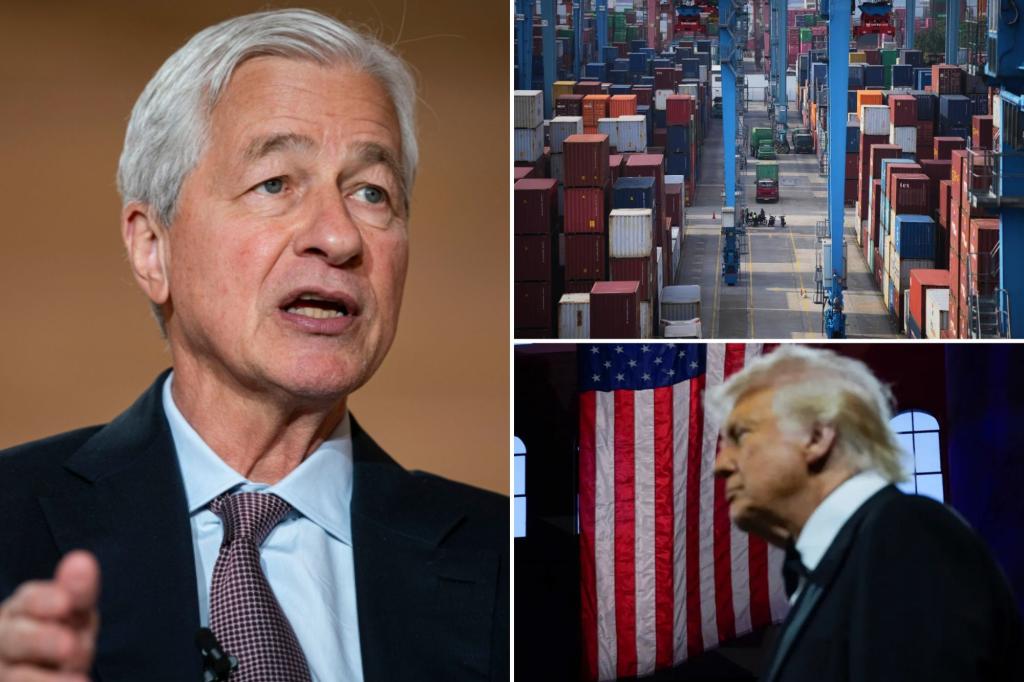

The JPMorgan Chase CEO, Jamie Dimon, warned Wednesday that the US economy is probably aimed at a recession due to Conerns growing about the intense commercial war with China.

In an appearance in Fox Business “” Mornings with María “, Dimon pointed out the recent volatility in financial markets as a sign of deepening economic problems.

“I think probably [a recession is] A probable result, because markets, I mean, when you see a 2,000 -point decrease [in the Dow Jones Industrial Average]He orders or feeds on himself, right? Hey said.

“It makes you feel that you are losing money in your 401 (k), you are losing money in your guest home. You have to reduce.”

His comments arrived in a strong sale of shares and bonds on Wednesday.

Futures for the main shares of shares fell sharply and treasure yields increased when investors weighed the implications of the latest retaliation rates between Washington and Beijing.

The feeling of the market was more grouped after China announced that it would impose a tariff of 84% to all US goods, a strong increase in previous levels, in response to recently promulgated US tariffs.

As uncertainty continues to increase, JPMorgan analysts have reviewed their perspective for the US economy, now predict a 0.3% contraction in the gross domestic product this year.

While it is relatively modest, the prognosis repeats a significant change in the previous expectations of continuous expansion.

“Markets are not always right, but sometimes they are right,” Dimon said.

“I think this time they are right because they are only uncertainty of pricing [at] The macro level and uncertainty [at] The micro level, at the actual level of the company, and then affects the feeling of the consumer. It is difficult to say it. “

Dimon’s position on tariffs has evolved.

Earlier this year, he minimized groups about commercial disputes, urging critics to “overcome it” and arguing that fashion inflation was Horth compensation, while protecting national interests.

However, their latest comments indicate a more cautious tone as economic consequences become more difficult to ignore.

Despite his Conerns, Dimon still urged political leaders to adopt a stable and diplomatic approach to resolve commercial tensions.

“Breathe deeply, negotiate some commercial offers. That’s the best they can do,” he said.

“I’m having a quiet vision. But I think I could get worse if we don’t advance here.”

The JPMorgan chief also gave him support behind the governor of the Federal Reserve Michelle Bowman, encouraging the Senate to confirm it as supervision vice president, the main regulatory position that supervises the US banking sector.

Bowman is expected to appear before the legislators in Thorsday for his Counter’s Court.

With the markets on the edge and the recession talk become stronger, Dimon’s comments highlight the urgent need for clarity and cooperation in commercial policy, and a hand parked in financial regulation.