If you have learning your legs to trade for a while, I am sure you have encountered the term ‘rape’.

What exactly does it mean?

Well, as expected, Vray means being excessive!

But how can you detect when your rape?

And what about bad trade?

Actually, the reasons behind both are numerous and extremely common for all merchants.

So is there anything you can do about it?

Fortunately, these are precisely the issues that I am going to cover for you in today’s guide!

I will share some crucial and practical tips to recognize when you are a violation …

… and show him how to improve his negotiation plan to help him eliminate him completely!

Specifically, you will learn:

- What exactly is Vray and the initial solution to avoid it?

- How to have a market selection puts it in a position to obtain more profits and less

- A risk management technique that maintains the losses for violation of a minimum so that it can return to the game as soon as possible

Sounds good?

Then let’s start …

What is rape and how can you avoid it?

The violation occurs when more trades enters than you can reasonably handle.

Now, a common situation in which a violation can occur is when it begins to “trade of revenge.”

Everyone’s leg …

Experience a couple of losses, lose composure and start going crazier in the markets …

Before you realize, enter operations completely outside your negotiation strategy!

Well, that is just one of the many situations in which crime can occur.

In a nutshell, violation is a mixture or a combination of the following:

- Not having a well -defined strategy

- Trade at random times of the day

- Jump from a time frame to another

- Revenge trade

Then, in summary …

The violation is due not to know what you are doing!

In other words, it occurs when you deal with trade as a game or game adjustment or business.

At this point, the beginning of the solution should be clear for now:

Develop a well -defined negotiation plan

I know it is easier to say it than to do it, since there are many ways to trade with the markets.

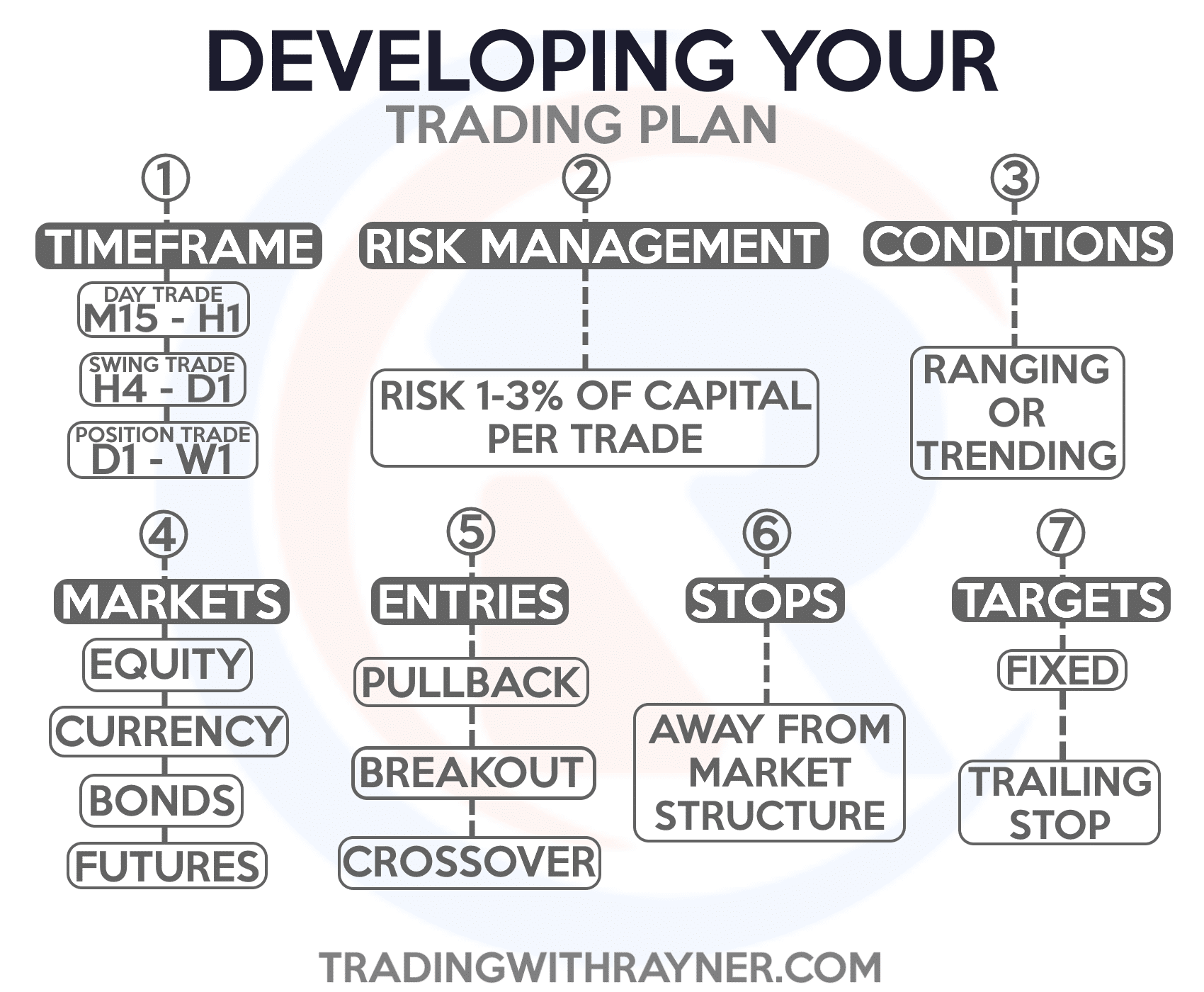

But taking into account this template will always put you ahead …

Of course, there are many ways to address the markets, so the type of negotiation plans will vary from one merchant to another.

You can consult an in -depth guide on some examples here.

Basically, maintaining a well -established negotiation plan will help it solve 50% of the symptoms that cause violation.

So now you can ask …

“What is the other 50% to help the violation of prevention?”

Simple …

Develop a well -defined negotiation routine.

This part is as important as developing a negotiation plan.

Because?

Separate merchants to those who treat trade as gambling and those who treat it as a business!

Having a well -defined negotiation routine helps you understand the right time to trade.

Let’s say you are someone who exchanges a higher term, such as the daily term …

… well, you just need to review the graphics once a day at a specific time.

But if you are one that exchanges a lower Tim frame, such as the Timframe of 15 minutes or less …

… How often do you think it is better to check the lists?

Surprisingly … what you can do is trade all day!

That’s how it is!

The fact that the scalp does not mean that it should negotiate all the time.

(The key in your case is only to trade when there is liquidity).

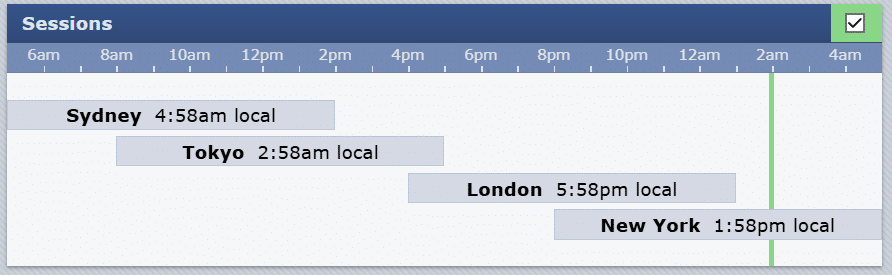

A good example is just exchange the overlap of the London-New York session …

Source: Forex Factory

This means that if I exchange the lowest deadlines, only exchange between 8 pm and 1 in the morning (at least in my time zone)

And you could be wired …

“Why this specific session?”

“Why don’t they overlap Sydney and Tokyo?”

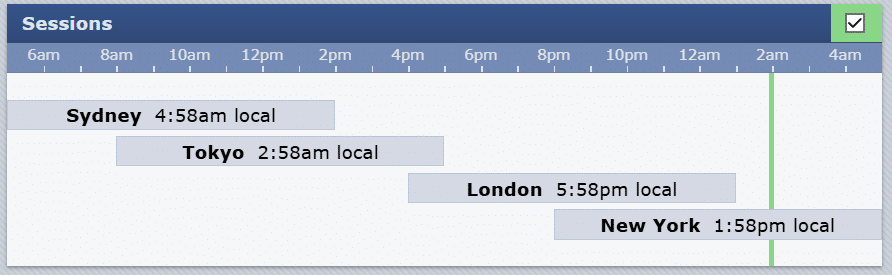

Well, it’s volatility, as you can see below …

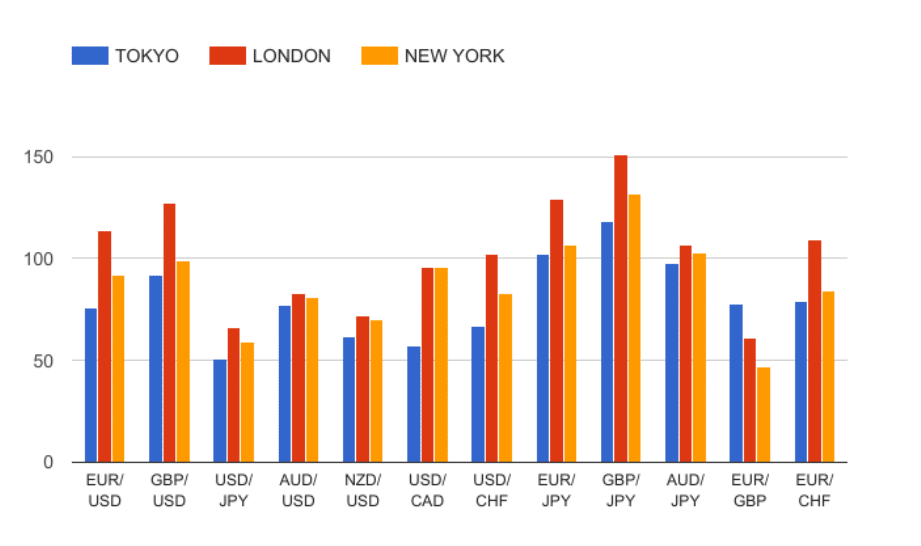

Source: Baby Tips

The market spends the longest duration of the London and New York session.

Take GBPJPY, for example, that it had a large PIP movement of around 150 pips duration of the London session!

To summarize this part, here is a leaf of tricks to which you can check depding about which Timma frame is:

- Daily term = Check once a day at a constant moment

- 1 hour to 4 hours = Check once every four hours

- 30 minutes and below = Eat active only duration of volative ax market sessions

Remember, the lower the deadline to be traded, the more important the market selection will be.

Knowing when and when not trade puts your head on an objective level, and this will help you avoid rape in markets.

Now, we are deeper, okay?

Just although I have shared some broad concepts with you, the question remains …

“How can you know exactly when your violation?”

Let me give you more context in the next section …

Market selection techniques that almost eliminate rape

Here is the thing …

Changing the definition of violation just having too many open trades can exclude many edge cases.

I mean, there are negotiation methods in which having 20 operations open at the same time can be beneficial!

On the other hand, there are some negotiation methods with a maximum open trade count of 5 or even less …

So what are these commercial methodologies, can you ask?

They are right here:

- Next trend (H4 – D1)

- Intradía Commerce (M5 – M30)

There are more commercial methods out there, but for now, let’s explore the thesis two more depth …

Next trend (H4 – D1)

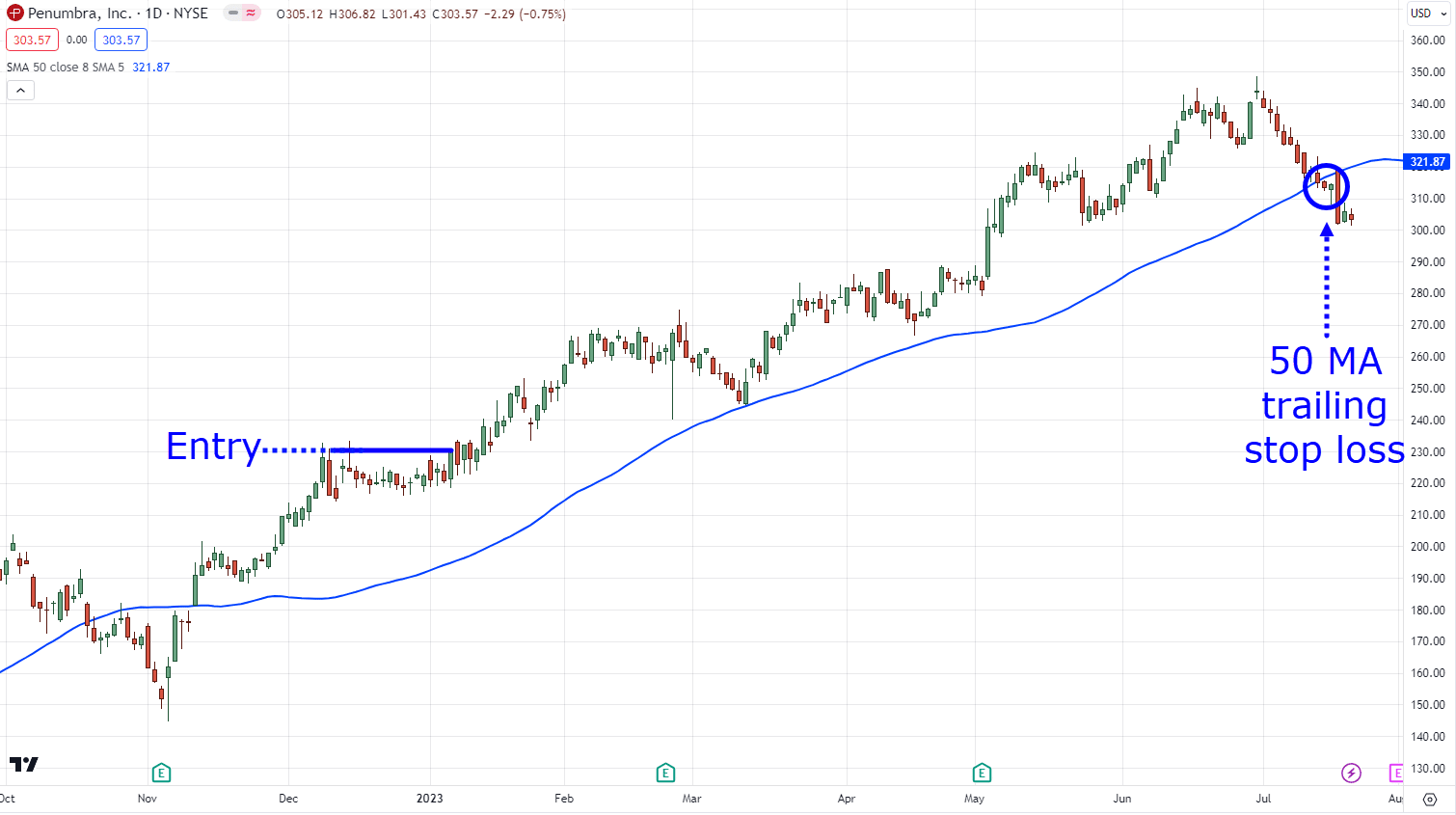

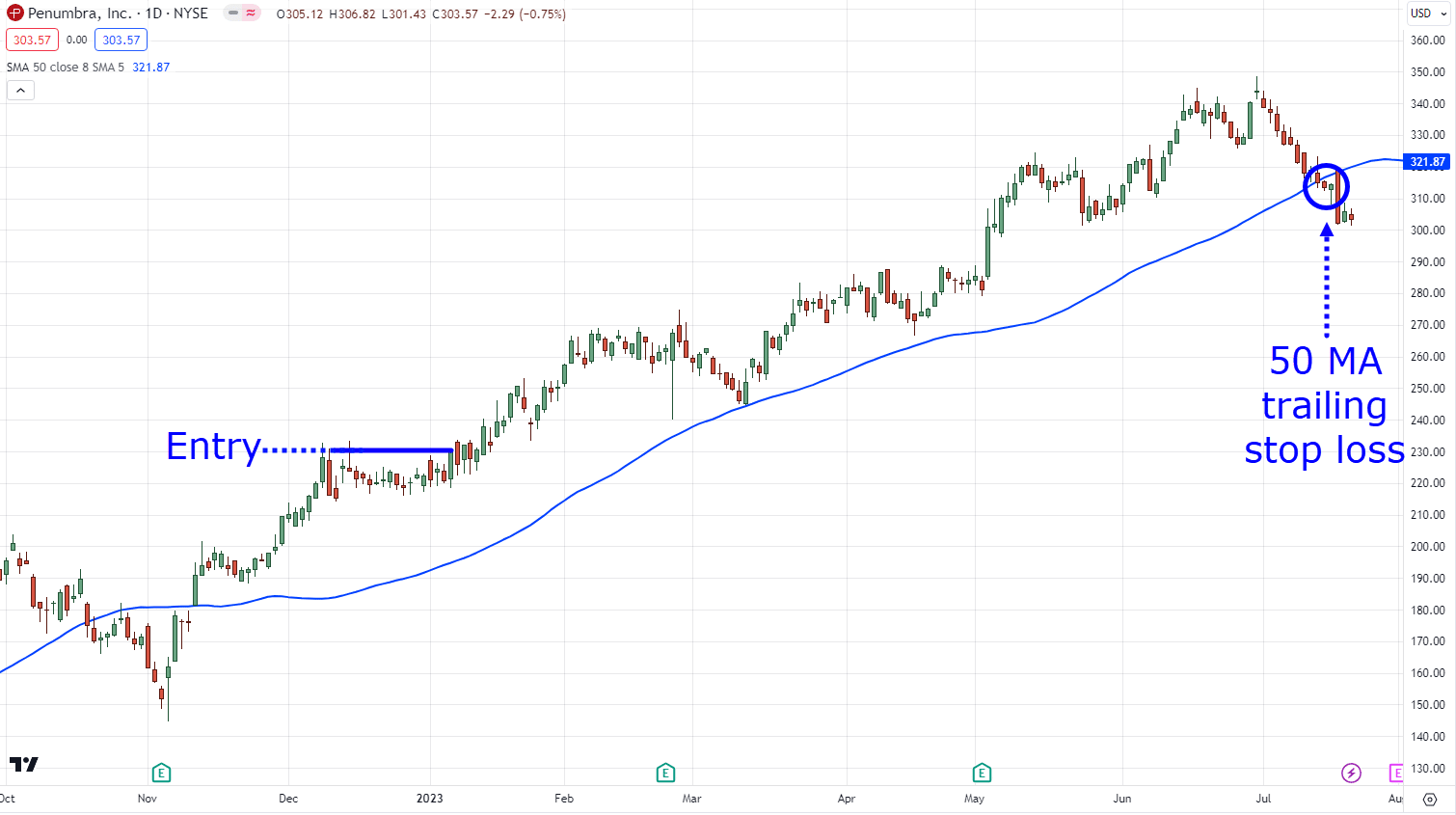

At this point, it is possible that he is already familiar with the following trend, where he tries to capture the trend all the time he can …

And as you can see, if the trend goes in your favor, your trade can last months!

(Also in a single trade!)

However, limit your Max Open operations to about 3 or 5 bottleneck your wallet.

Since following a trend can last a week or months, more diversification makes sense for this negotiation methodology.

In fact, it could potentially mean 10-20 operations open at the same time!

As a follower of the trend, this means that he pays him not only to look at the currency markets …

… but also look for products, indices, agriculture and bonds.

This will give access to a wide range of markets not correlated for trade.

On the other hand, what happens to intradic trade?

Intradía Commerce (M5 – M30)

With this negotiation methodology, it must be an active market sniper.

What do I mean?

Market selection

The more active your negotiation portfolio in the Forex market, the more important it is for you to carefully select your markets.

But … Where do you start?

How do you select the markets to trade?

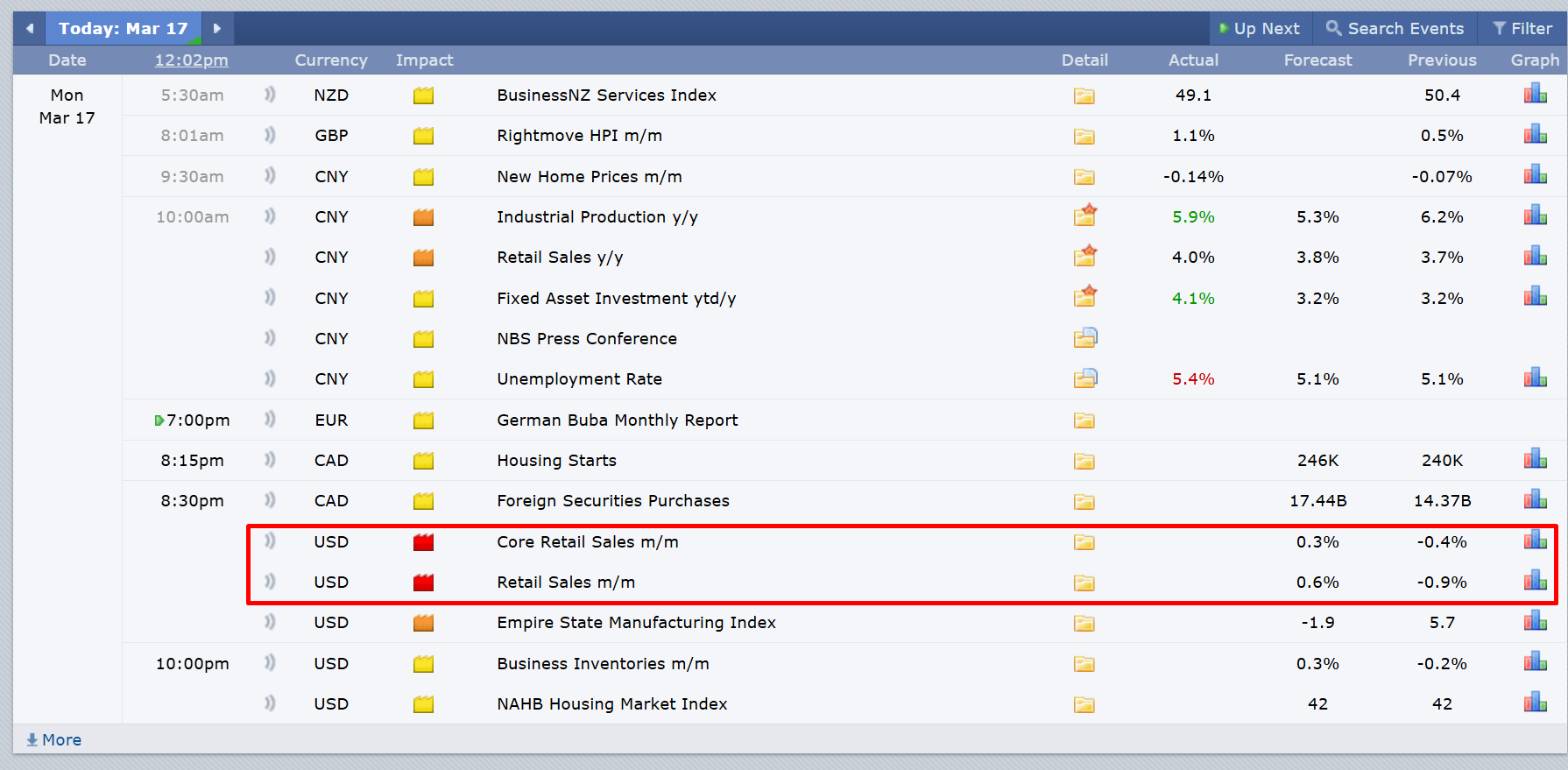

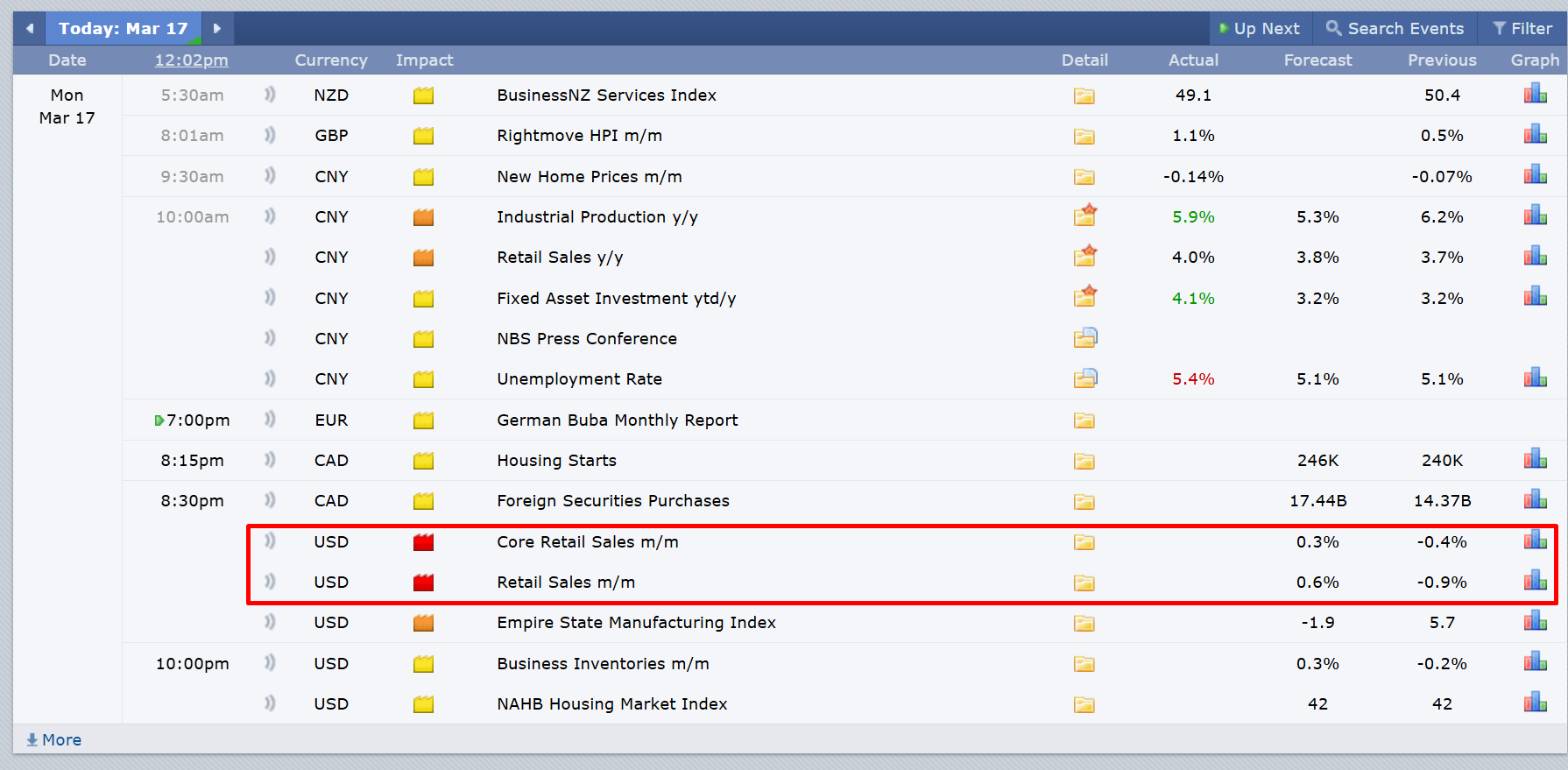

Well, it can be a combination of a couple of tools, but a method that I or use is to trade after high -impact news …

I am sure that you have heard a couple of times that you should try to “avoid” the high -impact commercial news.

In a way, that’s true!

You will not want to bet on how the news will go and trade before the press release …

… The key is to change the “reaction” to that news.

Do you get me?

When the news comes out, you don’t want to be in commerce.

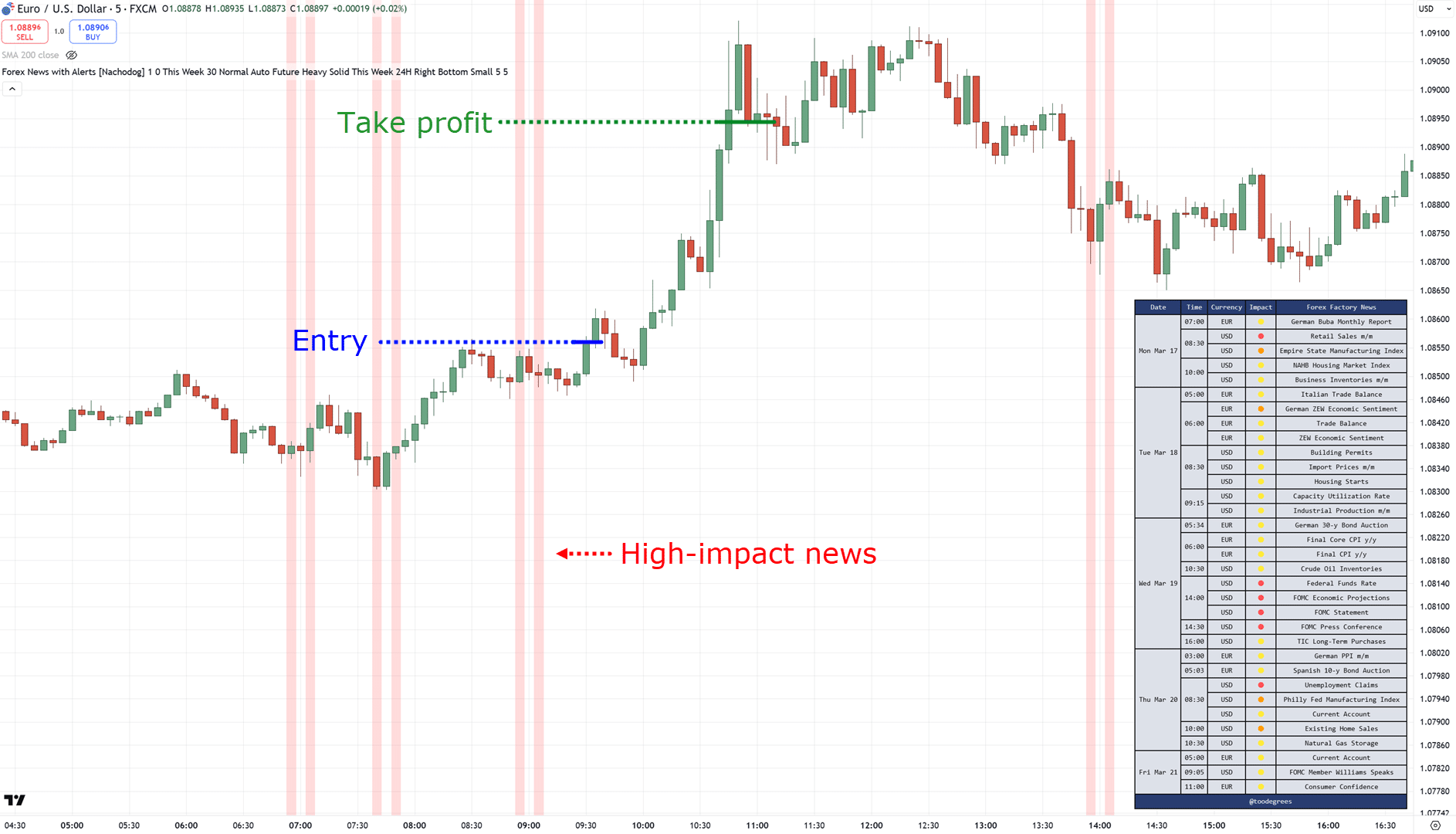

Here is an example of Euusend in the 5 -minute timframe …

As you can see, you just want to take advantage of the configuration after the news.

It’s about waiting for the reaction.

Of course, there are times when the market barely moves in press releases, but is attentive to meaningless.

P.S. Nachodog Forex news credits with alert indicator in TrainingView

In general, the principle is this …

- The lower the frequency of your trade, the more open it must have (diversity)

- The higher the frequency of your trade, the less open operations must have (concentration)

Make sense?

Excellent!

Know when to trade and how many open operations you should have …

… will greatly reduce the possibilities of violating the market.

Just take into account the reasoning behind your market selection.

Even so, mistakes are always going to commit.

Both you and I are human, and it is in our nature!

So what happens yes, despite all this, you still find a violation?

When your emotions are high and wake up in the middle of the revenge trade?

When applying what you have learned so far, the chans of this are lower …

… But how can you reduce damage?

Let me share with you in the next section …

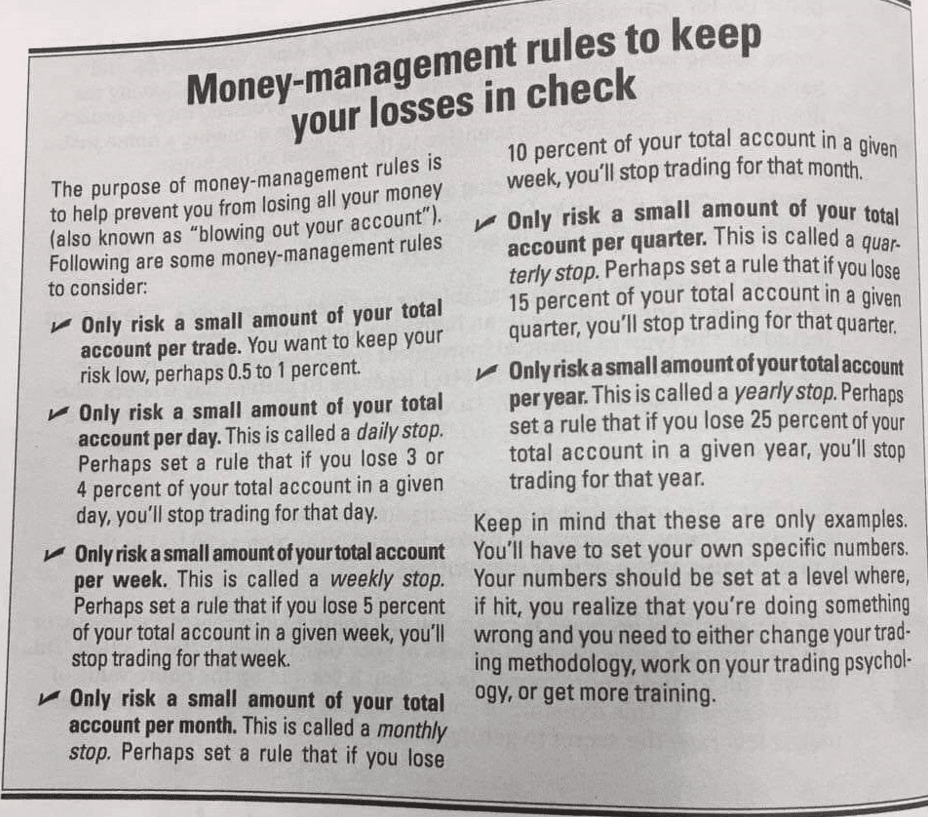

A risk management technique to reduce violation damage

This section is the most important part: to submit to the “human factor” in commerce.

Honestly, the best way to deal with him is to achieve risk management!

And not …

… Not the risk management you already know, limited to 1% or your account by trade …

Instead, I’m talking about emergency brake configuration!

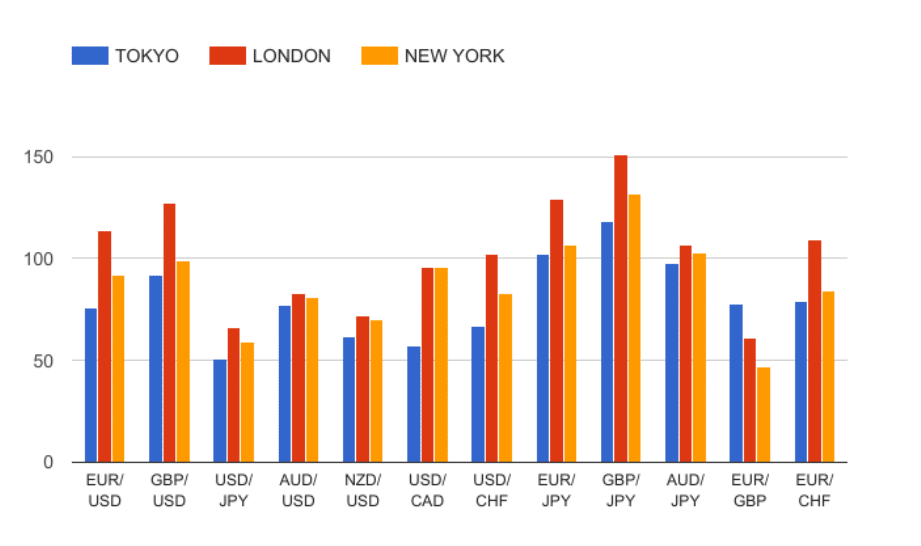

This leaf of tricks is a hidden jewel …

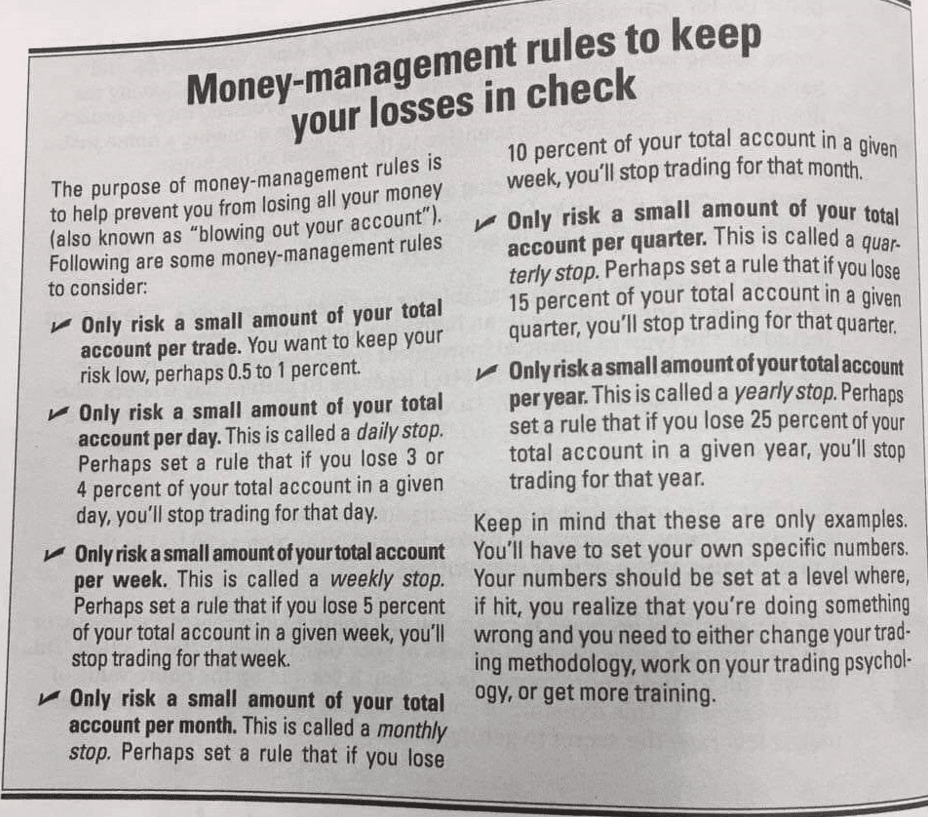

Source: Dummy Series, Trend Trading

However, you just need to use one that is more relevant to you.

For example …

If you are a Intradía merchantThen you will want to add the following parameters:

- 5% maximum risk per operation (commercial stop)

- 5% maximum risk per day (daily stop)

- Maximum 10% risk per week (weekly stop)

Again, this is the worst case, and those values are just a recommendation …

… You only know what your personality is like!

But in this case, if you have reached that loss of 5% for the day as an intradic negotiation, stop operating, re -evaluate your negotiation diary and return the next day.

If you run the risk of 0.5% per operation, this gives you a ton of breathing space, since it would take 10 losing operations in a row before reaching that 5%.

On the other hand, if these Next trend Within the highest period:

- 1% maximum risk per operation

- 10% maximum risk per quarter (quarterly stop)

- 25% maximum risk per year (annual stop)

As you can see, a daily or weekly stop is unnecessary since its commercial frequency is lower.

That is why having a quarterly or annual stop makes more sense.

Remember, the premise of this section is the fact that it is a chans that could still violate.

The key is to minimize that impact.

It gives you more space to breathe and the opportunity to stay in this business to improve.

Sounds good?

So, let’s have a quick summary of what you have learned today …

Conclusion

Vrease can happen for many different reasons!

It may be the lack of a commercial plan, to the bad commercial psychology or risk management.

But what I want you to take off of this commercial guide is an effort to balance the three.

Create solid risk management, consider your commercial psychology and have a well -defined negotiation plan.

Breaking it, this is what you have learned in today’s guide:

- Vray can happen when it does not have a well -defined negotiation plan or a clean negotiation routine

- The creation of a market selection rule that depends on its negotiation methodology helps to determine when it must and should not trade, helping to eliminate

- Having a maximum relevant risk limit helps reduce violation damage, which makes a “sausage scenario” simpler to deal with the general image.

Well, that’s it!

But now, I want to hear your side.

What are some rape stories that you have?

Was it after experienty five commercial losses in a row and deciding to throw your strategy out the window? (Who doesn’t?)

Or was it more a bet to exchange high -impact news before its launch?

Let me know your story in the comments below!