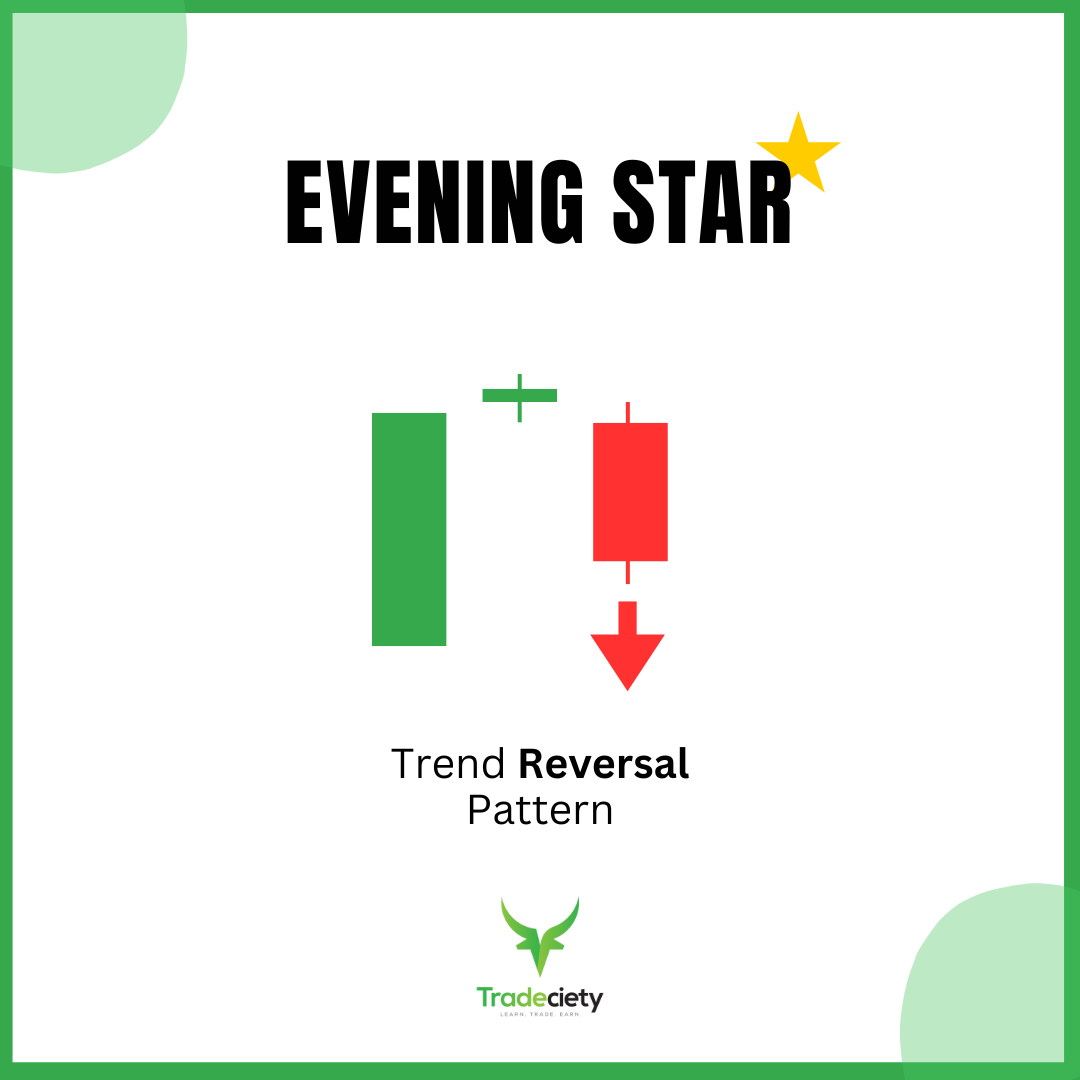

He Afternoon star pattern He is a powerful Bearerish investment pattern That indicates a potential change in the market direction of a bullish trend to a bearish trend. This classical candle formation is widely used by operators to predict trends reversions, especially after a prices manifestation sustained over a higher period of time.

The afternoon star consists of Three different candles:

-

Great bullish candle: This candle occurs a tendency to an upward trend and represents a strong ascending impulse, indicating that buyers have control.

-

Little indecisive candle: The second candle is typically a Rotating top ORPÍN Dojiwhich represents indecision in the market. It shows that the ascending impulse is being woven as buyers and vendors are in balance. It is not uncommon to see patterns of afternoon stars with Two or more Small undecided candles at the top.

-

Great bearish candle: The third candle confirms the investment closing well below the midpoint of the first bullish candle and below the minimum of the indecisive candle. This means that sellers have task control and can follow a bearish trend.

This candle formation is generally formed at the top of an upward trend, so it is a key sign for operators to anticipate a bearish movement.

Importance of market context

Understand when and where the star pattern is formed is crucial. This pattern usually appears in to Mature bullish trendWhere the upward trend for multiple waves has been carried out, leaving the Elliot Elliot wave sequence, and a reversal is Inmantad. When the afternoon star pattern is formed in a previous endurance The level provides more reliable signals with additional context.

Reliability deadlines

He Daily term It is the most reliable for the star pattern of the event, since it filters much of the noise in the shortest deadlines. However, the employer can also appear in Intradia graphicsHe thought that these shorter times can produce false signals more frequently. Swing merchants prefer daily or weekly graphics for more reliable signals, while daily merchants can look for the pattern on 1 hour or 4 hours lists.

Common traps in the identification of the afternoon star

-

False signals: In broken or lateral markets, the afternoon star may not predict a strong investment, which leads to false signals.

-

Ignoring the market context: It is crucial to use the Event Star pattern in the context of the correct market, mainly after a trend within reach. Using it in a consolidation market can lead to a misinterpretation.

The screenshot shows a scenario in which an event star is formed as a pattern in a consolidation phase after a bearish trend. As we have learned previously, the context is incorrect for a afternoon star pattern.

-

No trigger: In many cases, the afternoon star pattern is not triggered when the third bearish candle is not complete below the indecision candle. Merchants can be tempted to execute operations too soon when they see the third candle that is formed, but it is important to remember that the third candle has to close completely before executing operations.

Star Star vs Morning Star: key differences

While the Afternoon star It is a bearish investment pattern, its counterpart, the Morning star patternit’s a Alcista Investment Pattern. Both patterns share the same structure of three pancas, but appear in different market contexts:

- Afternoon star: It appears after an upward trend and indicates a bassist investment.

- Morning star: Apart after an bearish trend and indicates a bullish investment.

He Morning star It is formed when an bearish trend shows exhaustion, starting with a Big Candle, followed by a undecided Little candle, and ending with a Strong optimistic Sail, pointing out a possible upward investment. Both patterns complement each other in commercial strategies, offering opportunities to anticipate market reversions in both directions.

How to exchange the Candelabro Star Evening Star pattern

Successful trade Afternoon star pattern Requires a step by step approach:

1. confirming the trend

Make sure the afternoon star forms after a good defined Alcista Trend. If the market has been in upward trend for a while, the pattern is more likely to indicate a significant reversal.

The table below shows a night -star pattern in an upward trend that has just completed the Elliot wave sequence, which makes it more likely to see bass price movements.

2. Context of the graphic

Idly, only looks for events of events at the level of previous resistance or demand areas for an additional context. A pattern that occurs in a strong chart context can have a better signal power.

The afternoon star in the table below is just formed in an area of previous resistance and supply zone, providing a strong context of the graph.

3. Entry point

In general, merchants do not exchange the pattern of the afternoon star directly, but use the bearish signal of the afternoon stars pattern to find trade opportunities in the lowest deadlines. In this way, merchants can take advantage of the high time bias with precise entries in the lower schedules.

Following the previous signal, the lower term provides an input signal after the triangle pattern is broken.

Advanced tips to trade the pattern of the afternoon star

For the most experienced merchants, the afternoon star pattern can be improved using advanced techniques:

1. Combine with Fibonacci levels

Wearing Fibonacci setback The levels to identify the key support and resistance areas can help validate reversal resistance. If the third candle breaks through a key level of Fibonacci, it is a stronger signal.

2. Confirm divergence

Yeah RSI ORPÍN Macd It shows diversity (for example, higher in the price but to the maximum lower in RSI), points out that the upward trend is a fabric, which makes the afternoon star pattern more reliable.

3. Continuation stores

The afternoon star also functions as a trend continuation pattern. When a afternoon star pattern occurs at the top of a correction wave, it can produce reliable signs of trends monitoring.

4. Commerce on different deadlines

The pattern can be applied to different deadlines, but reliability changes. In scaleShort deadlines (such as graphics of 5 minutes or 15 minutes) can produce signals, but can be less reliable compared to Swing trade In daily or weekly graphics.

Conclusion

He Afternoon star candlestick pattern It is a valuable tool for merchants seeking to capitalize on bassist reversals in the market. Its ability to indicate the exhaustion of the trend makes it essential to predict market reversions. The afternoon star pattern is also a large upper Timframe bias filter, which allows merchants to adopt a framework approach from various times.

However, it is important to confirm the pattern with other indicators and support it in a demonstration account before trade.

Frequent questions

Can you use the afternoon stars pattern in all markets?

Yes, it can be applied to shares, currencies and crypto, although the yield can vary according to the market.

What is the difference between the afternoon star and other bearish investment patterns?

The afternoon star is a specific reversal pattern of three singles, which other bearish patterns (such as bearish envelope) have different formations and signals.

Is the afternoon star pattern reliable in a short period of time?

While it can appear in a short period of time, it is usually more reliable in daily or weekly cars due to reduced noise.

Can the afternoon star pattern form in a side market?

The afternoon star pattern is more effective when it is formed after a clear bullish trend. In a side or consolidating market, the pattern may not lead to a significant price reversion, which increases the risk of false signals. It is better to use this pattern only in trends markets for high reliability.

How does the sail size of the afternoon stars affects?

The size of the candlesticks can affect the strength of the pattern. A larger first bullish candle indicates a strong ascending impulse, while a second smaller candle shows indecision. The third bearish candle must be large and close below the midpoint of the first candle to confirm a strong reversal. If the candles are small and undecided, the pattern can be weaker.

How often does the afternoon star pattern appear in the market?

The pattern of the afternoon star does not appear frequently, since it requires specific market conditions: a previous upward trend, a change at the time and a clear investment signal. However, more than Overcompra markets Where prices exhaustion is more likely.

Should I wait for the hiring before tradeing the pattern of the afternoon star?

While some merchants enter immediately after the third candle, waiting for additional confirmation (such as a break below a key support level, a signal in a lower Tim frame or confirmation of indicators such as reduces the risk of false signals. This confirmation increases the hood of a successful trade.