The trend line channel patterns are a stadium in the technical analysis, which helps merchants identify possible commercial opportunities by drawing trends within the defined limits. These channels provide information on market trends, offering strategic entry and exit points for merchants. In this guide, we will explore how to identify, trade and optimize the channel pattern of the trend line to improve its commercial strategy.

At the end of this guide, you will have a solid understanding of how to exchange channel patterns, recognize different types and implement practical techniques to maximize your commercial success.

What is a trend line channel?

Definition of the trend line channel

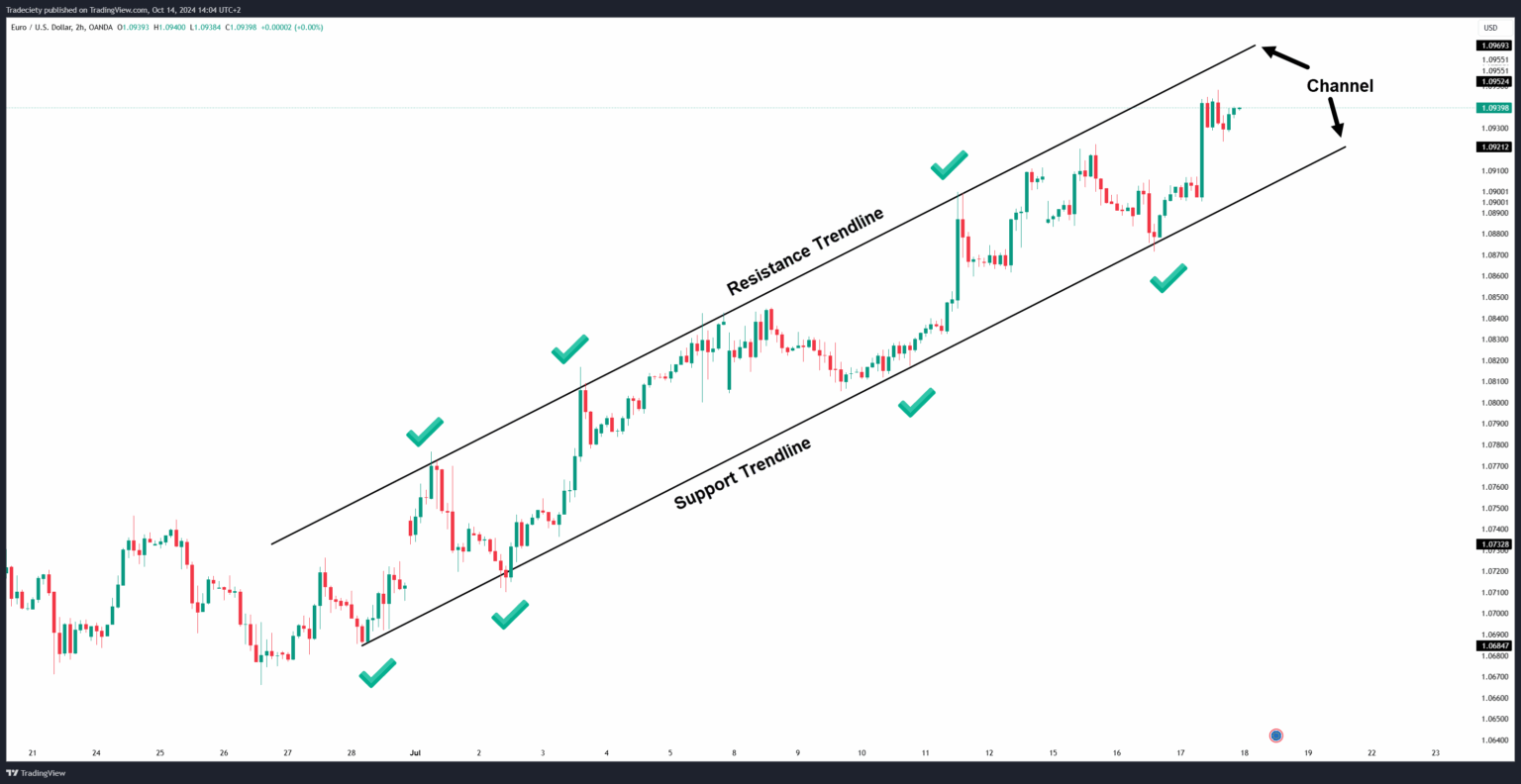

A PATERT trend channel is formed by two parallel trend lines that encapsulate the price movement within a market. These lines represent Support and resistance Levels, which mark the ups and downs that the price constantly respects over a given period.

-

The lower trend line acts as supportWhich indicates a price level in which the purchase pressure tends to avoid greater decreases.

-

The higher trend line works as enduranceMarking a price price where the sale pressure generally avoids more profits.

To make a channel valid, the price must play each line at least twice, creating a visually discernible pattern. The parallel nature of these lines helps merchants predict future price movements and identify possible commercial opportunities.

Types of trend line channels

Trending line channels can be classified into three main types:

Ascending channel (bullish pattern):

In an ascending channel, the price moves upwards inside the channel, indicating an upward trend. Both support and resistance lines are inclined up. Merchants often seek purchase opportunities at the lower limit (support) and take profits near the upper limit (resistance).

Descending channel (bearish pattern):

A descending channel reflects a bearish trend, where the price moves down. Both support and resistance lines are inclined down. Merchants can benefit by selling near the upper limit (resistance) and buy near the lower limit (support).

Horizontal channel (neutral pattern):

In a horizontal channel, the price moves from side to, with Neether a bias up or down. Both the support and resistance lines are flat, which represent a neutral market. Purchase merchants at the lower limit and are sold in the upper limit, capitalizing the oscillation within the range.

You can also refer to the lateral channels to the double blouse or triple tops.

How to identify a trend line channel

Drawing the trend lines

For the successful trade of a trend line channel pattern, the first step is to accurately draw the trend lines that mark the channel. Here is a step by step guide:

Identify ups and downs and minimums:

Start when detecting the ups and downs of the key (peaks) and rotating minimums (channels) in your graph. These are critical points in which the reverse price to the directive.

Connect the minimum and maximum:

Draw a line that connects at least two consecutive minimums to create the Support lineand another connecting at least two maximums to form the Resistance line. Make sure both lines are parallel, forming the channel.

It is fine if the trend lines are going through candlesticks and even through candle bodies sometimes. However, you do not want to see that the price is able to negotiate outside the line of trend for too long; When the price is quickly invested in the canal, it can be a line of trend and Consident channel. We will talk about trend counterfeiters later.

Tips for valid contact points

To confirm the validity of its trend line channel, look for multiple contact points: the price must reach the support and resistance lines at least twice, creating a consistent pattern. The more contact points, the stronger the channel is strong.

Recognizing valid channels

To avoid the trade of false channels, follow these rules for the broad:

-

Minimum touches:

A valid trend line channel must have at least two touches on support and resistance lines.

-

Consistent price movement:

The price must constantly move between the two lines, respecting the limits with false limited breaks.

-

Term:

The channels can be formed in several deadlines, from Intradía to weekly graphics. For short -term merchants, Daily or 4 -hour graphics Work well, while long -term merchants can prefer Weekly or monthly graphics To confirm broader trends.

How to exchange a trend line channel

Input strategies for trend line channels

Once you have identified a valid channel, the next step is to plan your entry points. Here are two common strategies:

Buy in Support, sell in Resistance

The most direct approach is to buy when the price reaches the lower trend line (support) and is sold when the higher trend line (resistance) reaches.

You can also choose to exchange bullish signs in the line of support trend within an ascending channel, filtering biseistic signals against the current trend. And vice versa.

Midline trade

The midline of a trend line channel also has some importance, especially in the largest channels that are wide. The price will often bounce in the midline, providing more support and resistance levels. These levels can be large levels of confluence at LOER schedules.

Trend line channel rupture strategy

The trend line channels do not last forever, and anyone, the price can leave the channel. Here we show you how to address the thesis scenarios:

Merchanting the rupture:

When the price is broken through the support or resistance line, it indicates the potential beginning of a new trend. Merchants can enter the market after a Rupture confirmation Or expect a test Or the broken level before entering.

Falcos del Channel

As the channel was mentioned, counterfeiters are common and, therefore, many merchants choose to follow a falsification strategy. For this, the merchant is ignoring the rupture signal and, instead, wait for the price to return to the channel. Identally, the movement back to the channel must occur with high impulse (large candlesticks) to indicate the strong falsification force.

Stop loss and take earnings

Effective risk management is essential to negotiate the channels of the trend line. Here we show you how to establish detention losses and earnings:

Stop losses

Establish your stop loss slightly outside the trend line: cure the lower limit (support) for long operations and above the upper limit (resistance) for short exchanges. This reduces the risk of being stopped by market noise or false outbreaks.

Take

Calculate your earnings according to the Channel width. If the channel has 100 pip wide, aim to take profits near that level from its entrance. The use of the channel width helps to ensure that your risk / delay ratio remains favorable.

Other objective approaches may include a fixed reward: risk ratio. For that, it establishes its loss of stop as explained above and then took a multiple of the distance of loss of loss as your level of gain. If your stop loss is 50 pip from your entry, your earnings is established at 100 points, providing a reward ratio 2: 1: risk.

Final tips to trade the successful trend line channel

Practice a demonstration account

Before jumping to live trade, it is crucial to try its channel trade strategy in a Demonstration account. Trade in a demonstration account is also excellent for practicing and improving its recognition of patterns with the pressure of the real money trade.

Continuously refine your strategy

Trade is a dynamic process, and the strategies that work today may need adjustments in the future. Maintaining a Commercial newspaper You can help you track your trades, evaluate your performance and refine your strategy over time. Reviewing your commercial data will help you identify areas to improve and keep it on the way to success.

Frequent questions (frequent questions)

P1: What is the best time frame for the trend line channels?

The ideal term depends on your commercial style. The merchants of the day may prefer graphics from 15 minutes to 1 hours, while the merchants of use of the 4 -hour or daily tables. Long -term merchants can opt for weekly or monthly cars to capture broader trends.

P2: How to know if a trend line channel is valid?

A valid trend line channel requires at least two touches on support and resistance lines, along with a constant price movement between them. A greater number of touches generally increases channel reliability.

P3: Can you use the trend line channels along with other patterns?

Yes, trend line channels can be combined with other graphics patterns, said axis triangles” flagsWorks Council Head and shouldersto create stronger commercial configurations.

P4: Is it possible to exchange channels in volatile markets?

While it is more challenging, channel trade is possible in volatile markets. However, it must be cautious with false outbreaks and broader price changes, which can make risk management more complicated.

Conclusion

Domain the channel pattern of the trend line can significantly improve your negotiation strategy. Whether you are negotiating in a bullish, bass or neutral market, these channels provide clear points of entry and exit, which helps you capitalize on price movements. Remember to practice in a demonstration account, continually refine your strategy and use solid risk management techniques to increase your chances of success.