“95% of all merchants fail” is the most used negotiation statistics on the Internet. But there is no research work that demonstrates this correct number. Research even suggests that the real figure is much, much higher. In the following article, we will show you 24 very surprising economic scientists discovered by analyzing the real data of the runners and the performance of the merchants. Some explain very well why most merchants lose money.

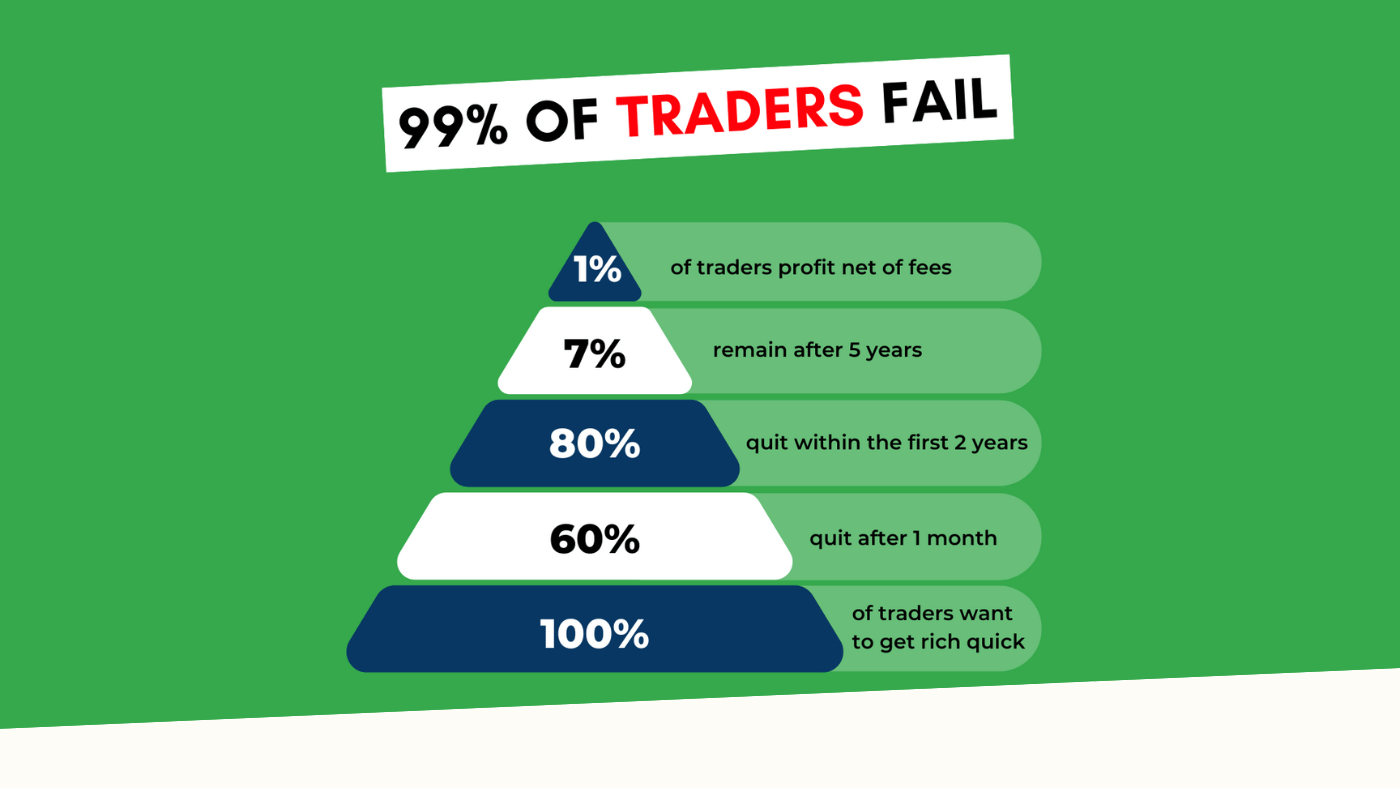

- 80% of all merchants of the day renounce in the first two years. 1

- Among every day merchants, almost 40% of the day trades for only one month. In three years, only 13% of continuous trade per day. After five years, only 7%are left. 1

- Merchants sell winners at a 50% hyger rate than losers. 60% or sales are winners, while 40% or sales are losers.2

- The average individual investor has an less than a market index by 1.5% per year. Active merchants have a lower performance by 6.5% per year. 3

- The merchants of the day with a strong FIT performance obtain strong yields in the future. He thought that only about 1% of all merchants of the day can obtain predictable profits or rates. 1

- Merchants with up to 10 years of negative record of continuous history of trade. This suggests that merchants of the day simply negative when they receive a negative signal regarding their capacity. 1

- Profitable day merchants constitute a small proportion of all merchants: 1.6% in the average year. However, these merchants of the day are very active, representing 12% of the commercial activity of every day. 1

- Among all merchants, profitable merchants increase their negotiation rather than non -profitable merchants. 1

- Poor people tend to spend a greater proportion of their income on lottery purchases and their lottery demand increases with a decrease in their income. 4

- Investors with a large differential between their existing economic conditions and their aspiration levels have more risky actions in their portfolios. 4

- Men trade more than women. And single men trade more than men. 5

- The poor young people, who live in urban areas and belong to specific minority groups, invest more in actions with lottery characteristics. 5

- Within each income group, players have a lower performance than those who are not one of those who do not have a bobler. 4

- Investors tend to sell winning investments while clinging to their losing investments. 6

- Taiwan trade fell by approximately 25% when a lottery was introduced in April 2002. 7

- Duration periods with unusually large prize of lottery, the trade of individual investors decreases. 8

- It is more likely that investors repudiate an action that previously sold with profits than one previously sold for a loss. 9

- An increase in search frequency [in a specific instrument] Predicts greater yields in the next two weeks. 10

- Individual investors trade more actively when their most recent operations succeeded.11

- Merchants do not learn about trade. “Trade to learn” is not more rational or profitable than playing the roulette to learn for the individual investor.1

- The average day operator loses money by considerable margin after adjusting transaction costs.

- [In Taiwan] Individual investors losses are approximately 2% or GDP.

- Overweight investors shares in the industry in which they are employed.

- Merchants with a high IQ tend to contain more mutual funds and a greater number of actions. Therefore, more than diversification effects benefit.

Conclusion: Why most merchants lose money is no longer surprising

After reviewing the 24 statistics, it is very obvious to know why merchants fail. Most of the time, commercial decisions are not based on solid investigation, proven trade methods or on their commercial magazine, but on emotions, the need for entertainment and hope of making a fortune in a short time.

What merchants always forget is that trade is a professional and requests skills that must be developed over the years. Therefore, take into account your commercial decisions and the opinion you have in commerce. Do not expect to be a millionaire for the end of the year, but take into account the possibilities that online trade has.

We, in Tradeciety, build the Edgewonk Trading Journal, which is a negotiation tool that allows operators to track and analyze their operations to improve their commercial performance. A negotiation newspaper is an excellent way to become a professional merchant and start taking trade seriously.

———

– 1Barber, Lee, Odean (2010): Do merchants for day learning rationally about their ability?

– 2Odean (1998): volume, volatility, price and profits when all merchants are above average

– 3Barber and Odean (2000): Trade is dangerous for their wealth: the performance of investment in common actions of individual investors

– 4 Kumar: Who plays in the stock market?

– 5 Barber, Odean (2001): Children will be children: gender, excess confidence and investment in common actions

– 6Calvet, Le, Campbell, J. and Sodini P. (2009). Fight or fly? Relarity of the portfolio for individual investors.

–7Barber, BM, Lee, Y., Liu, Y. and Odean, T. (2009). How much do individual investors lose when operating?

– 8Gao, X. and Lin, T. (2011). Do individual investors exchange actions such as gambling? Evidence of repeated natural experiments

– 9Strahilevitz, M., Odean, T. and Barber, B. (2011). Once burned, twice shy: how naive learning, counterfactuals and repentance affect the repurchase of the actions that previously.

– 10DA, Z., Engelberg, J. and Gao, P. (2011). In search of attention

– 11By, S., Gondhi, NR and Pochiraju, B. (2010). Does the sign matter more than size? An investigation into the source of excess investor confidence